12b. Financing State and Local Government

Completed in 2007, Boston's Central Artery/Tunnel Project — a.k.a. the "Big Dig" — was the largest, most complex, and most technologically challenging highway project in the U.S. Financing came from a combination of federal, state, and local funds.

Paying taxes is surely everyone's least favorite government-related activity. But taxing citizens is one of the concurrent powers of government. Federal, state, and local levels all have the power to tax.

Of course, people expect state and local governments to provide services such as police protection, education, highway building and maintenance, welfare programs, and hospital and health care. Taxes are a major source of income to pay for these services and many others that hit close to home. For most people, their local and state tax money pays for very visible services that they generally take for granted, except when something goes wrong with garbage collection, traffic lights, or snow removal. People are most likely to get involved with local and state governments when these basic services go wrong.

Expenses

The single biggest expenditure in all states is education, with the average state and the localities within it spending just less than one-quarter of its budget for public schools. Funding for education comes primarily from the local school district budget, but most state governments give a great deal of financial and administrative support to schools. Other big budget items for state and local governments are the following:

- Public welfare

- Health care

- Highways

- Police and fire protection

- Interest on debt

- Utilities and liquor stores

What would you do if there was a tax that didn't provide for the basic needs and services of your local area, and instead went to some monarch on another continent? Early American colonists had an answer. This cartoon from 1774 reads: "The Bostonians paying the excise-man or tarring and feathering."

Each of these items is less than 10% of state and local expenditures in most states, but together they make up a good portion of the expenses.

Income

Counties, townships, cities, and states collect some of their money from licenses and fees and state-operated businesses, but about half of state revenue comes from taxes. Two other sources of income are grants from the federal government and, in some states, lotteries. Most states and localities levy three types of taxes:

- Sales taxes are the most important source of revenue for states. It is placed on various products, and customers pay the tax when they buy them. Today 45 states have a general sales tax that applies to most goods, although food is usually excluded, and sometimes clothing is exempt. Some cities also collect sales tax.

- Income taxes are imposed by all but a handful of states on personal and corporate incomes. Personal income taxes are generally progressive; that is, they are graduated so that the rate goes up with the size of the income. States generally do not allow local governments to levy income taxes, but some municipalities impose a payroll tax on people that work within their borders.

- Property taxes provide the chief source of income for local governments today. Taxes are levied on land, buildings, and personal dwellings. Property must be assessed for its value, and most cities employ tax assessors for that job. Property taxes are controversial because other types of property, such as stocks, bonds, and bank accounts, generally are not taxed. Those who hold "real" property, then, pay a disproportionate share of the taxes.

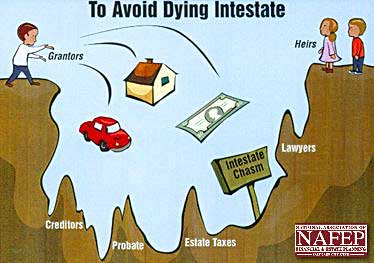

You've heard about "death and taxes" but this is a double whammy: if a person dies "intestate" — without having created a will or trust for his or her heirs — both federal and state governments are poised to take a hefty chunk of that person's estate by imposing inheritance and estate taxes.

Other taxes include inheritance and estate taxes imposed when a person dies and wills property to heirs. Several states have severance taxes, levied on those that extract natural resources such as coal, oil, timber, and gas from the land. Almost all states place special excise taxes on gasoline, liquor, automobiles, and cigarettes.

Most states get more than a quarter of their income from federal grants that usually come with restrictions as to how the money can be used. Federal grants often go for building projects, such as roads, bridges, and dams, and for education, health care, and welfare.

In 1964, the New Hampshire Legislature created the first legal state lottery of the 20th century. Here, the first ticket is sold to Governor John W. King.

In recent years more and more states have turned to lotteries to pay their expenses. Billions of dollars now come from lotteries, with states retaining about one-third of the money as proceeds. Some states designate that the money be spent on something special, such as education, the arts, or building projects. Lotteries are controversial because some people believe that lotteries hurt lower-income people, who buy most of the tickets.

Taxes, federal grants, fees, licenses, and lotteries support state and local budgets. Most people understand more about where their state and local taxes and fees go than they do about federal expenditures. Perhaps that is because state and local services tend to affect their personal lives more directly. Still, many complain that they do not get their money's worth. It is always easier to recognize the pinch that taxes bring than the services most people take for granted.