59b. Reaganomics

President Ronald Reagan unveils a new tax program, calling it "a second American Revolution for hope and opportunity." Upon taking office, Reagan called for a phased 30% tax cut, but Congress would only agree to a 25% cut.

The media called it Reaganomics.

During the campaign of 1980, Ronald Reagan announced a recipe to fix the nation's economic mess. He claimed an undue tax burden, excessive government regulation, and massive social spending programs hampered growth. Reagan proposed a phased 30% tax cut for the first three years of his Presidency. The bulk of the cut would be concentrated at the upper income levels. The economic theory behind the wisdom of such a plan was called supply-side or trickle-down economics.

By using laser-equipped satellites, Ronald Reagan's Strategic Defense Initiative hoped to shield the United States from a Russian missile attack. Here, a rocket sends a military satellite into the heavens.

Tax relief for the rich would enable them to spend and invest more. This new spending would stimulate the economy and create new jobs. Reagan believed that a tax cut of this nature would ultimately generate even more revenue for the federal government. The Congress was not as sure as Reagan, but they did approve a 25% cut during Reagan's first term.

The results of this plan were mixed. Initially, the Federal Reserve Board believed the tax cut would re-ignite inflation and raise interest rates. This sparked a deep recession in 1981 and 1982. The high interest rates caused the value of the dollar to rise on the international exchange market, making American goods more expensive abroad. As a result, exports decreased while imports increased. Eventually, the economy stabilized in 1983, and the remaining years of Reagan's administration showed national growth.

The defense industry boomed as well. Reagan insisted that the United States was open to a "window of vulnerability" to the Soviet Union regarding nuclear defense. Massive government contracts were awarded to defense firms to upgrade the nation's military. Reagan even proposed a space-based missile defense system called the Strategic Defense Initiative. Scientists were dubious about the feasibility of a laser-guided system that could shoot down enemy missiles. Critics labeled the plan "Star Wars."

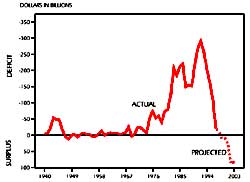

Ronald Reagan's increased spending and accompanying tax cuts resulted in dramatic budget deficits during the 1980s. A deficit occurs when spending exceeds revenues in any year. The drop you see at the end of this chart represents recent attempts to achieve a "balanced budget" — a spending plan where the funds available for use equal the funds spent by the federal government.

Economists disagreed over the achievements of Reaganomics. Tax cuts plus increased military spending would cost the federal government trillions of dollars. Reagan advocated paying for these expenses by slashing government programs. In the end, the Congress approved his tax and defense plans, but refused to make any deep cuts to the welfare state. Even Reagan himself was squeamish about attacking popular programs like Social Security and Medicare, which consume the largest percentages of taxpayer dollars. The results were skyrocketing deficits.

The national debt tripled from one to three trillion dollars during the Reagan Years. The President and conservatives in Congress cried for a balanced budget amendment, but neither branch had the discipline to propose or enact a balanced budget. The growth that Americans enjoyed during the 1980s came at a huge price for the generations to follow.